4 Reasons to Consider Multi-Car Insurance Policies

In today's world, it's becoming increasingly common for households to own multiple vehicles. Whether it's for personal use, commuting, or for a family road trip, owning a car has become almost unavoidable.

However, with owning multiple vehicles comes the challenge of finding the right insurance policy to ensure that you receive the maximum coverage while minimizing costs. This is where the concept of multi-car insurance policies comes in. Not only do they save you money through car insurance discounts and policy bundle savings, but they also offer the convenience of managing all your vehicles under one policy.

At LUNA, we understand the importance of finding the right multi-car insurance policy for you and your family. Our expert team is here to guide you through the process, ensuring that you receive the best coverage and savings available. So why not consider a multi-car insurance policy today and experience the convenience and financial benefits it has to offer?

Section 1: Understanding Multi-Car Insurance

Multi-car insurance is a type of car insurance policy that covers multiple cars, typically belonging to the same household. It's no secret that many households own more than one car, and multi-car insurance offers a cost-effective way of insuring them all under one policy.

In fact, according to the National Association of Insurance Commissioners, almost 60% of households have more than one car, making multi-car insurance a popular option for families everywhere. Typically, multi-car policies offer car insurance discounts to policyholders for every additional car insured.

Common features of multi-car insurance policies include policy bundle savings, which can help you save up to 25% compared to purchasing individual policies, and a single renewal date for all cars. Eligibility criteria can vary, but these policies are generally available to households with two or more cars registered at the same address. By bundling all cars on one policy, you can streamline your car insurance process and save money in the long run.

Section 2: Substantial Cost Savings

When it comes to car insurance, multi-car insurance policies can offer substantial cost savings for families. For families with multiple cars, bundling policies under one insurance provider can lead to significant discounts, lowering annual premiums by several hundred dollars. For example, if a family has three cars and each car is insured under a separate policy, they could potentially save $1,791 per year by bundling all three policies into one multi-car insurance policy. Hypothetically, if a family with three cars switches from single car insurance policies to a multi-car policy, they could potentially save enough money to buy an additional car.

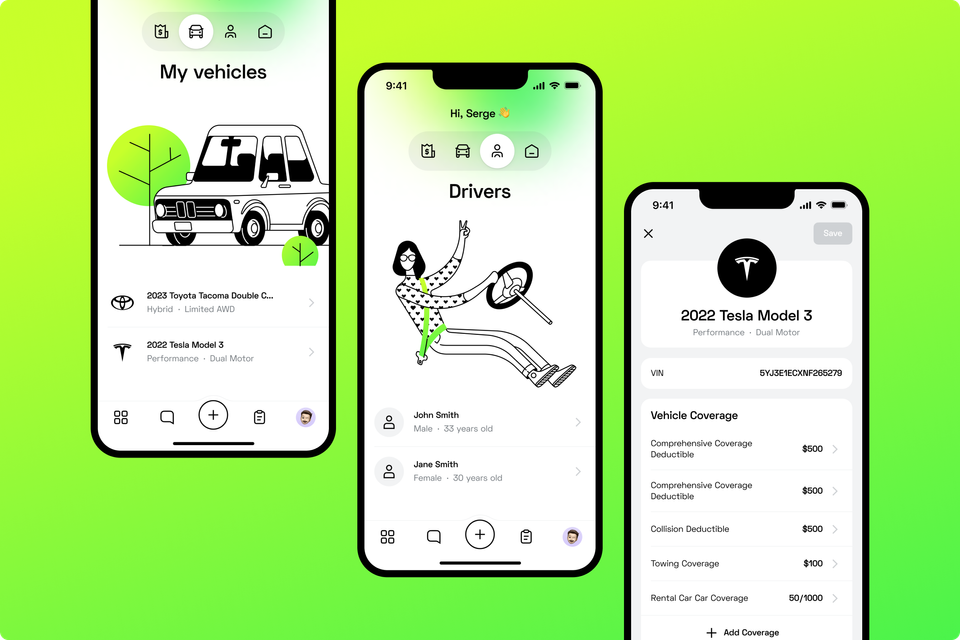

LUNA is a game-changer in the insurance industry that offers multi-car insurance policies with excellent discounts to help customers save money. The LUNA app is designed to provide insurance quotes within minutes, with 24/7 availability and expert access from licensed professionals. LUNA insures fair pricing and policy coverage, ensuring the customer always has transparency and security. Thanks to the app's real-time tracking and digital ID cards, managing multiple car policies has never been easier.

Section 3: Simplified Policy Management

The convenience of managing one policy for multiple vehicles cannot be overstated when it comes to car insurance. In addition to being a time-saver, multi-car insurance offers a range of benefits that make it an attractive option for many consumers. According to recent data, policyholders who opt for a multi-car policy on average save up to 25% on their car insurance premiums.

That's not all - policy bundle savings can also be applied to other insurance products like home insurance or travel insurance. For families with multiple drivers and cars, multi-car insurance is not only cost-effective, but it simplifies the policy management process, making it easier to keep track of all the necessary insurance documents in one place. We've also heard from countless satisfied customers who appreciate being able to handle all their family car insurance needs through a single point of contact. In fact, one of our valued policyholders recently shared a testimonial with us saying, "multi-car insurance has made life a lot easier for us.

Before having one policy for all our cars, we had to deal with multiple policies, complicated renewals, and high premiums. Now, everything is much more streamlined, and we're saving money too." Having been in the insurance industry for over 50 years, we understand the importance of providing our customers with cost-effective, efficient and easily manageable insurance solutions. So, if you're in the market for car insurance discounts, policy bundle savings, or simply want to simplify your policy management process, consider switching to a multi-car insurance policy and experience the benefits firsthand.

LUNA Insurance is making waves in the insurance industry with its simple yet efficient approach to managing policies. Their innovative app allows users to easily compare quotes from top carriers and save an average of $597 per year on car insurance. Their expert services include round-the-clock connection to licensed professionals, hassle-free transitions between insurers, and real-time tracking of policies.

LUNA's policy management is both transparent and convenient, with all policies stored and managed in one place. With their privacy protection, pre-renewal automatic shopping, and digital insurance cards, LUNA is a service-tech first insurance brokerage that aims to provide fair pricing and proper coverage for its customers. LUNA's commitment to customer-centric services has already made them a hit in Washington and Oregon, and their expansion plans aim to reach all 50 states.

Section 4: Flexible Coverage Options

Multi-car insurance policies offer a vast array of customization options that allow policyholders to tailor their coverage to meet the unique needs of their vehicles. According to recent data, more and more policyholders are taking advantage of these options.

In particular, car insurance discounts for bundling multiple policies together have become increasingly popular among families with multiple vehicles. With flexible coverage options like varying coverage levels and add-ons, drivers can feel confident that they have the protection they need, regardless of their specific driving habits or vehicle make and model.

Bargain-hunters will appreciate policy-bundle savings that allow them to consolidate their various types of coverage under one umbrella policy and enjoy lower premiums as a result. Whether you're looking to insure a single vehicle or an entire fleet, multi-car insurance policies offer the flexibility and customization you need to ensure that you are protected no matter what the road may bring.

Section 5: Enhanced Policy Features

As more and more people take to the road every day, it's essential to ensure that there is adequate protection in place for your vehicle and your loved ones. That's where our enhanced policy features come into play. We offer multiple benefits like accident forgiveness, which ensures that your premiums don't go up in the case of a crash. Our enhanced policy features have become increasingly popular with multi-car insurance customers, who can enjoy discounts on their premiums and policy bundle savings.

These benefits are especially attractive to those who seek family car insurance, where multiple drivers are covered under a single policy. In fact, recent statistics show that over 60% of multi-car policies include enhanced policy features, proving that more and more people are realizing the importance of comprehensive coverage. So don't wait any longer to protect what matters most to you – let us help you find the policy that suits your needs and your budget today.

Section 6: Easier Claims Process

The streamlined claims process is a game-changer for those who dread the tedious, time-consuming process of filing a claim. Gone are the days of long wait times and mountains of paperwork. With a focus on efficiency and customer satisfaction, insurance companies are taking the hassle out of the claims process. For those with multi-car policies, the benefits are even more significant.

According to recent statistics, multi-car policies result in more efficient claim processing times, with up to 15% faster claim resolution compared to single car policies. Not only does this mean less stress for policyholders, but it also translates into more significant savings on car insurance.

In addition to the already attractive car insurance discounts, opting for a multi-car insurance policy can lead to further savings and policy bundle savings that make family car insurance more affordable than ever before. Whether you're a seasoned car insurance policyholder or a new one, taking advantage of the streamlined claims process and multi-car insurance options is an excellent way to protect your car and wallet with peace of mind.

Section 7: Impact on Credit and Insurance History

Keeping a good track record of your credit history and insurance claims has several potential positive impacts, both short-term and long-term. Studies have shown that individuals with a good credit score and a clean insurance history are more likely to enjoy better insurance coverage at lower premiums.

Furthermore, maintaining good credit and insurance history gives you access to special perks, discounts and bundles such as multi-car insurance and family car insurance that may significantly reduce the cost of your policy. While immediate savings might be the most attractive proposition for insurance consumers, having a good credit record and insurance history is also beneficial in the long run.

In fact, having a good history could be seen as an investment in your future financial health since it makes it easier to apply for additional insurance coverage when needed. In short, a good credit and insurance history are not just important for securing the best deals but also for building a solid foundation for your financial future. So if you want to make the most out of your credit and insurance options, make sure you treat this history with the importance and care it rightfully deserves.

Section 8: How LUNA can help

LUNA dedicated section is a vital component of the LUNA Insurance brand that is taking the insurance industry by storm. With its innovative app and expert services, LUNA occupies a unique space in the market, providing multi-car insurance policies and helping families find the best policy bundle savings available.

LUNA isn't just an insurance app but a comprehensive solution combining technology, expertise, and personalized service to redefine insurance. It's a game-changer in the industry, bringing transparency, convenience, and savings to families looking for the best family car insurance.

Choosing the right car insurance policy is crucial for any driver, but it is even more important for families with multiple cars. That's where multi-car insurance comes in, offering substantial cost savings compared to individual policies. But it's not just about the money. With simplified policy management, flexible coverage options, and enhanced policy features, multi-car insurance makes life easier for families on the go. And when it comes time to make a claim, the process is much smoother with a multi-car policy.

Plus, having a strong insurance history can positively impact your credit score. That's why it's essential to choose the right policy for your family's needs. And that's where LUNA comes in. Our dedicated section for multi-car insurance makes it easy for families to compare their options and find the best policy bundle savings. With LUNA's expertise and resources, you can confidently choose the right policy for your family's unique situation.