LUNA’s Guide: The Difference Between Car Insurance and Warranties

As car owners, we understand the significance of protecting our vehicles from unforeseen damages, accidents, or theft. However, a common confusion that arises among many is the difference between car insurance and warranties. While car insurance offers financial coverage against risks such as accidents, theft, or legal liability, warranties provide protection for mechanical failures and defects in the car's parts.

The distinction between the two is crucial for informed decision-making, As we move towards 2024, the world of auto insurance is bound to transform, making it essential to keep up with the changes. Therefore, understanding the differences between car insurance and warranties is crucial in acquiring the right protection for your vehicle. In this guide, we will explore these differences in detail to help you make an informed decision that suits your unique needs. By the end of this guide, you will have a clear understanding of how car insurance and warranties differ and which one you need to protect your car.

Section 1: What is Car Insurance?

Car insurance is a financial product that offers coverage for damages, injuries, and liabilities associated with car accidents. The primary purpose of car insurance is to protect drivers from potential financial losses associated with accidents, theft, or other unforeseen circumstances while driving.

Several types of car insurance coverage are available, each with different benefits and drawbacks. Liability coverage is the most common type of car insurance and is required by law in most states. It covers damages and injuries that drivers cause to others in an accident. Comprehensive coverage, on the other hand, offers more extensive protection, including damage caused by natural disasters, fires, and theft.

Collision coverage focuses on repairing or replacing the driver's car after an accident.The auto insurance industry is continuously evolving, and projections indicate that in 2024, car insurance premiums are expected to rise by up to 20 percent. Understanding the different types of car insurance coverage available can help drivers make informed decisions and ensure they have adequate insurance protection when needed.

Section 2: What is a Car Warranty?

As car owners, we understand that with ownership comes the responsibility of maintenance and upkeep. However, what if something happens unexpectedly and your car needs repairs? This is where a car warranty comes into play. A car warranty acts as a safety net, providing coverage for repairs and replacement parts deemed necessary due to mechanical failure or defects. In essence, it protects your

financial investment in the vehicle. There are two types of warranties: manufacturer warranties and extended warranties. Manufacturer warranties are provided by the automaker for a specific period of time, usually three to five years, which can cover everything from powertrain components to electronics. Extended warranties, on the other hand, can be purchased from third-party providers and offer to extend coverage beyond the original warranty period. As an individual who has invested in an car, by being knowledgeable and investing in a car warranty, you are taking a proactive step in protecting yourself and your car.

Section 3: Key Differences Between Insurance and Warranties

When it comes to protecting your vehicle, knowing the differences between insurance and warranties can save you a considerable amount of money and stress. First and foremost, car insurance is specifically designed to provide financial assistance in the event of an accident or theft. In contrast, a warranty is a contractual agreement between the manufacturer and the owner to repair or replace certain components that fail due to manufacturing defects or workmanship issues.

While insurance covers unexpected events, warranties are intended to cover defects that might cause problems down the road. The duration is also vastly different. Auto insurance typically lasts for a year, with renewals required annually, while warranties can last up to several years, depending on the manufacturer's policy.

Alternatively, warranties are more beneficial for car owners who prefer to have peace of mind regarding the potential breakdown of vital car components. In 2024, with the rapid advancement of technology, innovations within the automobile industry are sure to contribute to changes in insurance policies and warranties.

Section 4: Financial Implications of Insurance and Warranties

When it comes to car ownership, insurance and warranties are two important financial considerations. Drivers will want to ensure that they have the appropriate coverage in case of accidents or other incidents, and warranties can act as a safety net for mechanical troubles.

However, it's important to consider the costs of insurance and warranties, as they can vary greatly depending on the provider and level of coverage. Drivers should also consider potential savings, such as bundling insurance policies or taking advantage of safe driving discounts.

Looking ahead, experts predict changes to auto insurance in 2024 with the increasing prevalence of autonomous vehicles. As such, drivers should stay informed and weigh the options carefully to make the best financial decisions regarding their car insurance and warranties.

LUNA, an innovative insurance and warranty platform, is a valuable tool for consumers seeking to understand the financial implications of insurance and warranties. With LUNA's comprehensive analytics and data-driven approach, consumers gain insights into the various options available to them, enabling them to make an informed decision about their car insurance or warranty choices.

Whether you're purchasing new coverage or assessing an existing policy, LUNA's expertise and analytical capabilities help you navigate the complexities of this critical area.

Section 5: Choosing the Right Insurance and Warranty for Your Vehicle

Choosing the right insurance and warranty for your vehicle can seem like a daunting task, especially with the vast array of options available in today's market. When selecting coverage, it is important to consider the type of vehicle you own, how frequently you will be using it, and your personal preferences as the owner. Additionally, with the ever-evolving advancements in technology, it is prudent to consider an auto insurance plan that provides coverage for newer vehicle models, such as those expected to be released in 2024.

By conducting thorough research and carefully evaluating your individual needs as a vehicle owner, you can make an informed decision when choosing insurance and warranty plans that offer the best possible protection for your automobile.

Section 6: Claims and Service Processes

Navigating the claims and service processes for car insurance and warranties can be complex. For those traveling overseas, it's crucial to ensure that you have adequate vehicle coverage and an understanding of the claims process in the event of an accident or mechanical failure. When it comes to car insurance, with the recent introduction of policies like 2024 auto insurance, new technologies and partnership models have streamlined the claims process, making it more efficient for policyholders to get their claims approved quickly.

In contrast, warranties can be more challenging to navigate, with various levels of coverage and exclusions, making it crucial to read the terms and conditions carefully before making any claims. To ensure a smooth experience, it's crucial to maintain detailed records of any incidents, including photos and other relevant documentation, and to notify your insurance provider promptly. By following these tips, you can navigate the claims and service processes for car insurance and warranties with confidence and ease, ensuring that you get the support you need when you need it most.

Section 8: Future Trends in Vehicle Coverage

The world is undoubtedly experiencing a transition in the automotive industry, consequently shaping the future of car insurance and warranty offerings. As more and more vehicle manufacturers continue to materialize, so does the need for international car insurance coverage. the advancement of artificial intelligence and smart technologies will drastically change how auto insurance is offered and processed.

The rise of usage-based insurance plans will make it convenient for drivers to track their driving patterns, thereby enabling customized car insurance premiums, based on individual drivers' habits. Moreover, car makers will soon seek to circumvent car insurance premiums with self-driving vehicles. However, in a scenario where a self-driving car gets involved in an accident, the carmakers' warranty on the car would take precedence, leading to more emphasis on the warranty offerings than traditional auto insurance. Understanding these emerging trends in car insurance and warranty offerings is vital for car insurance providers to remain competitive in an ever-transforming industry.

Section 9: LUNA Dedicated Section

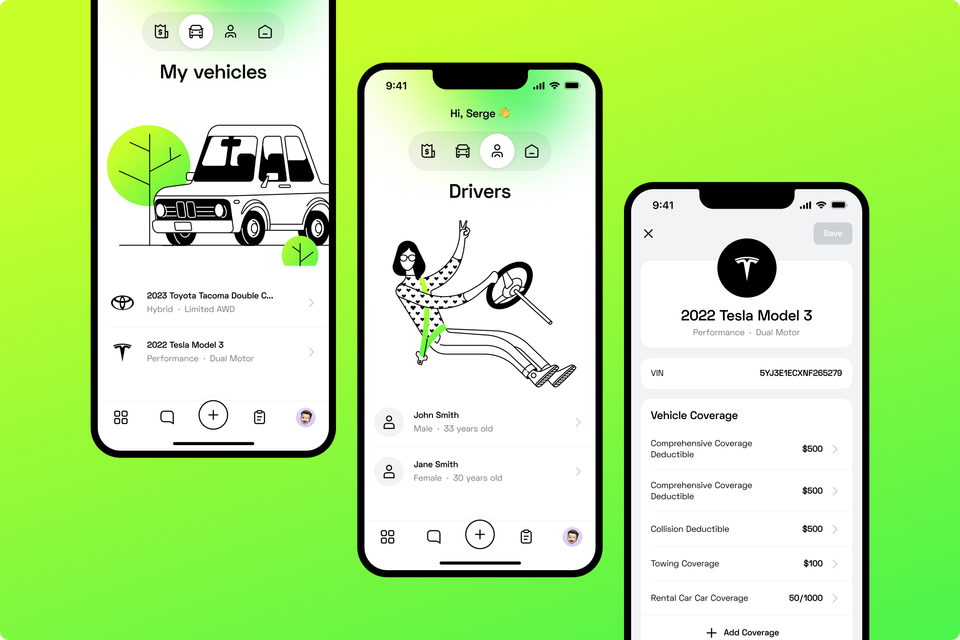

LUNA Insurance, a service-tech-first insurance brokerage, is dedicated to helping customers make informed decisions when it comes to choosing between car insurance and warranties. With their innovative app and expert services, LUNA provides efficient, simple, cost-effective, and hassle-free insurance solutions regardless of whether the vehicle is domestic or international.

LUNA users can effortlessly compare the top three quotes, enjoy real-time tracking, manage all their policies in one place, and gain access to licensed professionals around the clock. LUNA simplifies the process of moving between insurers, cancelling policies, and obtaining digital ID's. LUNA ensures privacy protection, pre-renewal automatic shopping, and fair pricing, and offers digital insurance cards and 24/7 agent availability. LUNA provides clear information and guidance while making it easy for you to make the best decision for your needs. With LUNA, you will get the best car insurance for your vehicle, whether you need international car insurance, overseas vehicle coverage, or auto insurance.

As a responsible car owner, it is crucial to understand the difference between car insurance and warranties. While both provide protection for your vehicle, they have key distinctions that should not be overlooked. Car insurance typically covers damages resulting from accidents, theft, and certain other events, whereas warranties cover mechanical breakdowns and other defects. It is important to note that warranties often have limitations and exclusions. The financial implications of car insurance and warranties can also differ significantly.

Car insurance is typically renewed periodically, while warranties typically have a set duration and may be purchased at the time of sale or separately. When making decisions about vehicle coverage, it is essential to choose the right insurance and warranty for your unique needs. Claims and service processes may also vary making proper documentation very important. Common misconceptions and frequently asked questions regarding car insurance and warranties abound. Future trends in international car insurance and overseas vehicle coverage may also impact your decisions. At LUNA, we are dedicated to providing support and guidance throughout the entire process of selecting and managing your auto insurance and vehicle warranties. With the right information, you can make informed decisions that will keep you—and your vehicle—protected.