Is It Better to Lease or Buy a Car? Pros and Cons You Should Know

A car is one of the largest purchases you’ll make in life — right behind a home and an education. While purchasing a car is a massive achievement, prices have reached an all-time high, making buying a vehicle outright a far fetched dream for many.

Instead, leasing may seem like the best alternative, but is it a solid financial decision? Here’s what you should know.

Lease vs. Buy: What’s the Difference?

Leasing a car means that you’re essentially renting it for a set period of time, typically two to three years. During the lease period, you make monthly payments to the leasing company to use the car.

At the end of the lease term, you have the option to return it to the leasing company, purchase the car outright, or lease another vehicle.

If you purchase a car, you own it outright. If you finance it, you’ll make payments to the lender, but you’ll build equity in the vehicle as you pay it off.

*According to Experian data.

Pros and Cons of Leasing a Car

Pros of Leasing

More affordable monthly payments. On average, lease payments tend to be lower than car loan payments because you’re only paying for the depreciation of the car during the lease term. You won’t have the same interest costs as you would with a loan.

You can lease a vehicle you couldn’t afford to purchase outright. Because the monthly payments are lower, leasing may allow you to drive a vehicle you couldn’t afford to purchase.

When you’re done with the lease, you don’t have to worry about selling it. If you purchase a car, you’ll need to decide whether to donate, sell, or trade in your vehicle. With a lease, you don’t have to worry about it.

You can experience different cars more frequently. Once the lease term is complete, you can opt to purchase the car outright, continue leasing the same vehicle, or lease a different vehicle. This allows you to try new cars every few years.

You won’t have to worry about maintenance outside of routine care. Leased vehicles often come with a three year bumper-to-bumper warranty, so you won’t have to worry about unforeseen expenses. You’re only responsible for routine maintenance like oil changes, air filter replacement, and inspections.

Cons of Leasing

Mileage restrictions may be a nuisance. Leased vehicles come with a mileage maximum — or the number of miles you’re allowed to put on the vehicle each year — often around 10,000 miles. If you exceed this limit, you’ll face an excess mileage penalty of around $0.15 to $0.25 per mile over the maximum.

While this might not sound like a big deal upfront, life changes. If, during the lease term, you accept a new job or experience another life change that leads to a longer commute, it may make for a tricky situation.

It can cost you more in the long run. A lease may have a lower monthly payment, but after considering the resale value of a purchased vehicle, it can actually cost you more to lease.

You’ll always have a monthly payment. As long as you have a lease, you’ll have to fork over cash every month. You will never reach a point of having paid the vehicle off unless you buy it outright.

You won’t own the vehicle. This means you can’t customize it, which can be a major downside if you like to personalize your car. You also won’t be building equity as you make payments.

You’ll need to keep the car in good shape. Leasing companies understand that general wear and tear will occur to the vehicle. However, if you have pets or kids and expect more than the standard level of damage, you may get hit with an excess wear and tear fee when you return the leased vehicle.

If you return the vehicle early, you’ll have to pay a fee. Lessors aren’t obligated to accept an early lease termination, so you’d have to find someone to take over the lease or face an early termination fee. This fee is often the amount left on the lease minus the value of the vehicle, which can be significant.

Pros and Cons of Buying a Car

Pros of Buying a Car

You can customize it. Because the vehicle is yours, there’s no leasing company telling you what you can and can’t do to the vehicle.

No mileage restrictions. The average American drives 13,476 miles per year, which may exceed the maximum allowed on a leased vehicle. With a vehicle you own, however, you can drive as many miles as you’d like without facing a penalty.

It’s property you own. Purchasing a vehicle is like purchasing a home — as you make payments, you build equity. Then, when you’re done driving the vehicle, you have the option to sell it and make some of your money back.

There are no fees. With a leased vehicle, there are penalties for a variety of things — early termination, excess wear and tear, excess mileage, and more. With a vehicle you own, there are no fees.

Cons of Buying a Car

All maintenance is on you. Unlike a leased vehicle, anything that happens to the car is on you. Routine maintenance — like oil changes and tire rotations — plus unforeseen circumstances like towing and door dents are your responsibility.

Higher monthly payment. Car loans tend to have higher monthly payments due to interest costs.

The car may depreciate quickly. Cars are depreciating assets, meaning the second you drive it off the lot, its value declines. If you plan to sell the vehicle down the line, you won’t sell it for nearly as much as you paid for it.

You can’t swap it out as easily as a leased vehicle. If you’re someone who likes to drive a new vehicle every few years, purchasing a new vehicle each time might make for a complicated process.

Insurance Options

In the” lease versus buy debate,” one of the most overlooked factors is insurance options and pricing.

If you lease or finance a vehicle, your lessor or lender will typically require you to carry both collision and comprehensive insurance policies. If you purchase a vehicle in cash, you can decide which insurance option you’d like.

If you opt to finance the vehicle, you can change insurance plans once you've paid the vehicle off. If you lease the vehicle, you’ll need to carry the required insurance until your lease is up. You will not be able to select less coverage than your lessor requires, which means you’re on the hook for whatever the required insurance costs for the entire duration of your lease.

Depending on where you live, there could be a major difference in price — like a $1,500 per year difference. When deciding whether leasing or buying is better for you, make sure to factor in the price of insurance.

Real Cost Breakdown

Before the COVID-19 pandemic, around 34% of consumers opted to lease their vehicles. Now, just 19% do. This is due to higher prices, a stronger desire to own a vehicle, and less appealing lease offers.

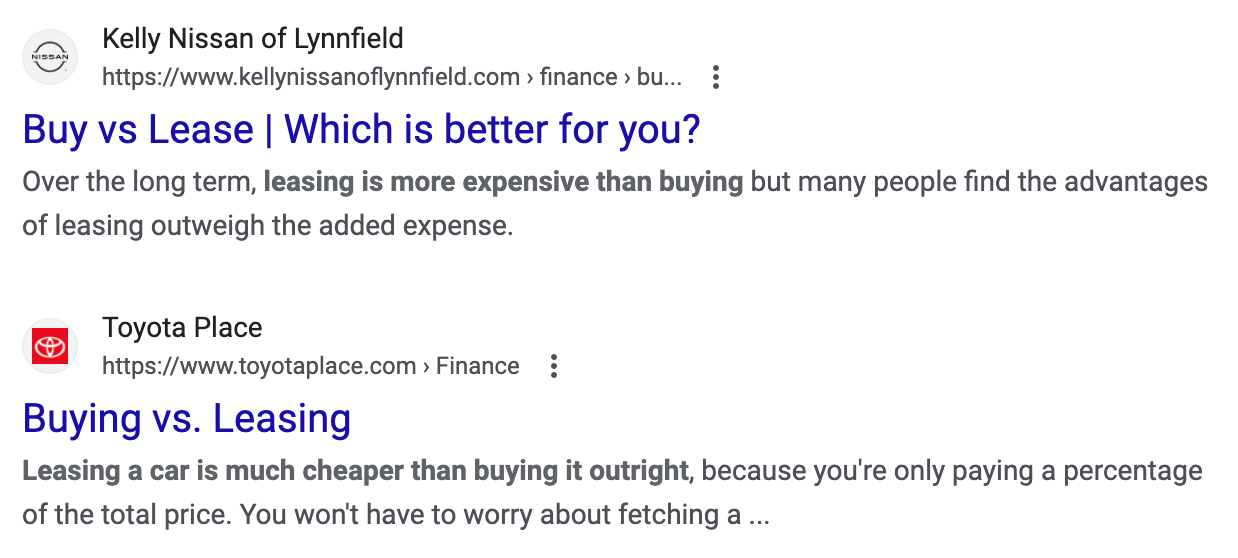

In turn, this is harming the used car market — an important factor in our economy. This may impact the way car salesmen present lease offers, making them appear more financially beneficial than they are. See Exhibit A below.

Performing a true cost breakdown is the best way to examine the difference in price. So, here’s how it’d look to lease and purchase the same vehicle — a $23,750 2023 Honda Civic — in the state of Massachusetts.

*Calculations were done without fees, such as registration, advertising, and documentation fees for simplicity. A rate of 6.25% sales tax was applied. A depreciation of 14% after 4 years was used, or a residual value of $20,425. Average maintenance costs assume 10,000 miles are driven per year, and only routine maintenance costs are covered.

Keep in mind that once the four years have passed, you will have paid $45,194.99 to own the Honda Civic, or $34,818.27 to rent the vehicle. Should you decide to sell the Honda Civic, you’d likely get a decent bit back. At the time of writing, four-year-old used Honda Civics with around 40,000 miles are selling for $24,405.

Should You Lease or Buy a New Car?

It depends on your unique circumstances. Here’s a general guideline for when to lease and buy:

You should lease a vehicle if you:

- Enjoy driving new cars every few years.

- Need a temporary transportation solution (ie. You plan to move to New York City in two years and won’t need a car with you.)

- Need a vehicle but cannot afford the monthly payment for a purchased vehicle.

You should buy a vehicle if you:

- Need transportation for the long-term.

- Want to own property.

- Don’t want a never-ending monthly payment.

- Have kids or pets and plan to have a significant amount of wear and tear over the years.